Chapter 7: Payroll Obligations on Termination of Employment

7.5 Incorporating Termination Payments into the Determination of Payroll

7.5.1 Calculating Net Pay on Termination (Last Paycheque)

Work through the following example:

Shayenne works for RAD in British Columbia and earns an annual salary of $74,600.00, paid biweekly. Shayenne’s employment will be terminated at the end of this pay period. She is entitled to 6% vacation pay on her vacationable earnings of $78,000.00 and five weeks’ wages in lieu of notice. Her vacation pay and wages in lieu of notice will be paid together on a separate payment from her regular pay.

Shayenne’s federal and provincial TD1 claim codes are 3. She will not reach the Canada Pension Plan or Employment Insurance annual maximums this pay period.

Calculate the employee’s net pay on the separate payment. Use 2022 rates.

Hint: Use the bonus method when calculating income taxes.

7.5.2 Prepare a Record of Employment (ROE)

7.5.2.1 What is a Record of Employment?

A Record of Employment (ROE) is a form completed by the employer that reflects the employee’s employment history with an organization. This record allows the employee to apply for employment insurance (EI) benefits if they meet the qualifications.

7.5.2.2 When to Issue an ROE

Employers are required to issue a Record of Employment (ROE) after an employee is terminated. The ROE provides information about the employee’s employment history and is used to determine the employee’s eligibility for employment insurance benefits.

7.4.3 How to Prepare an ROE

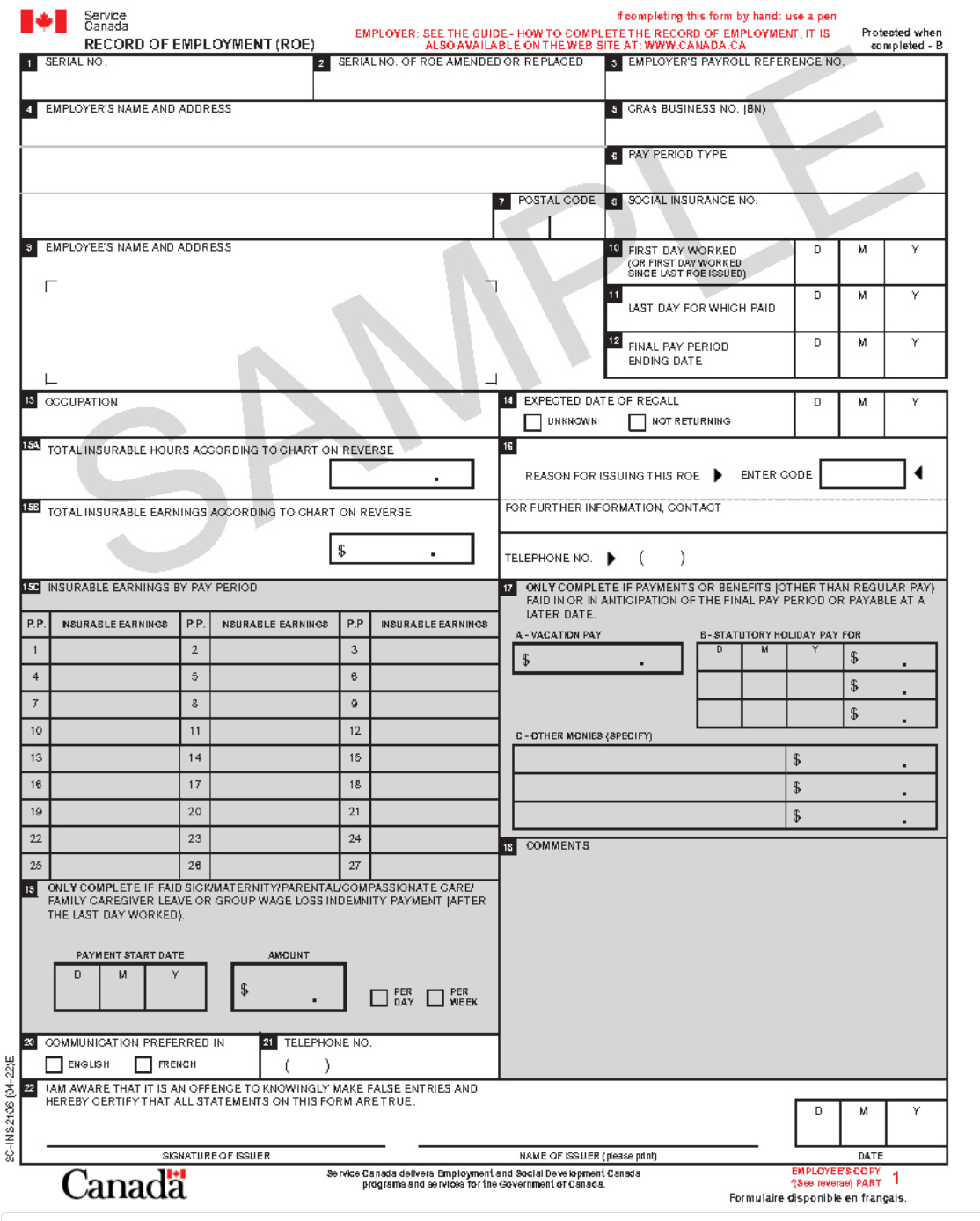

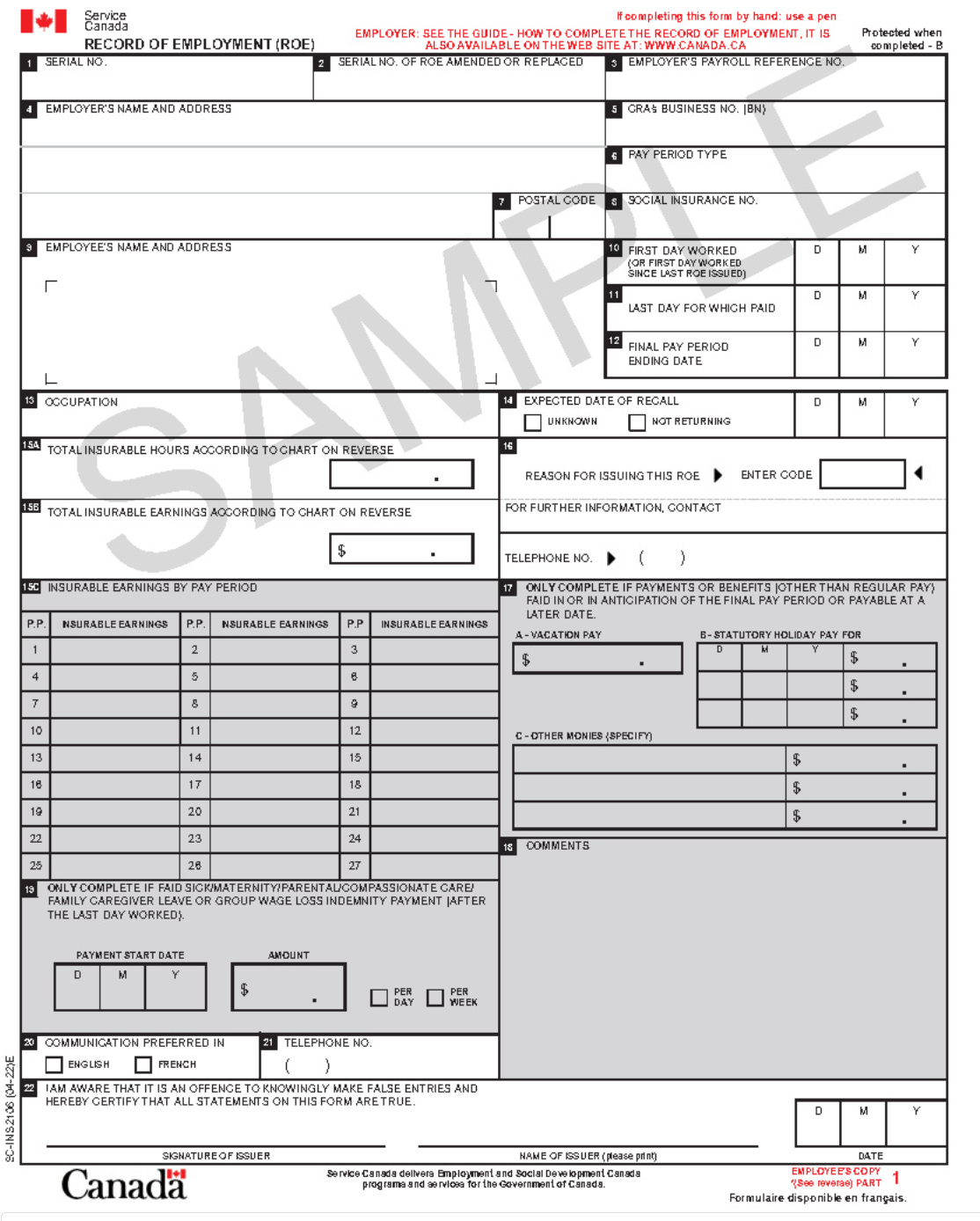

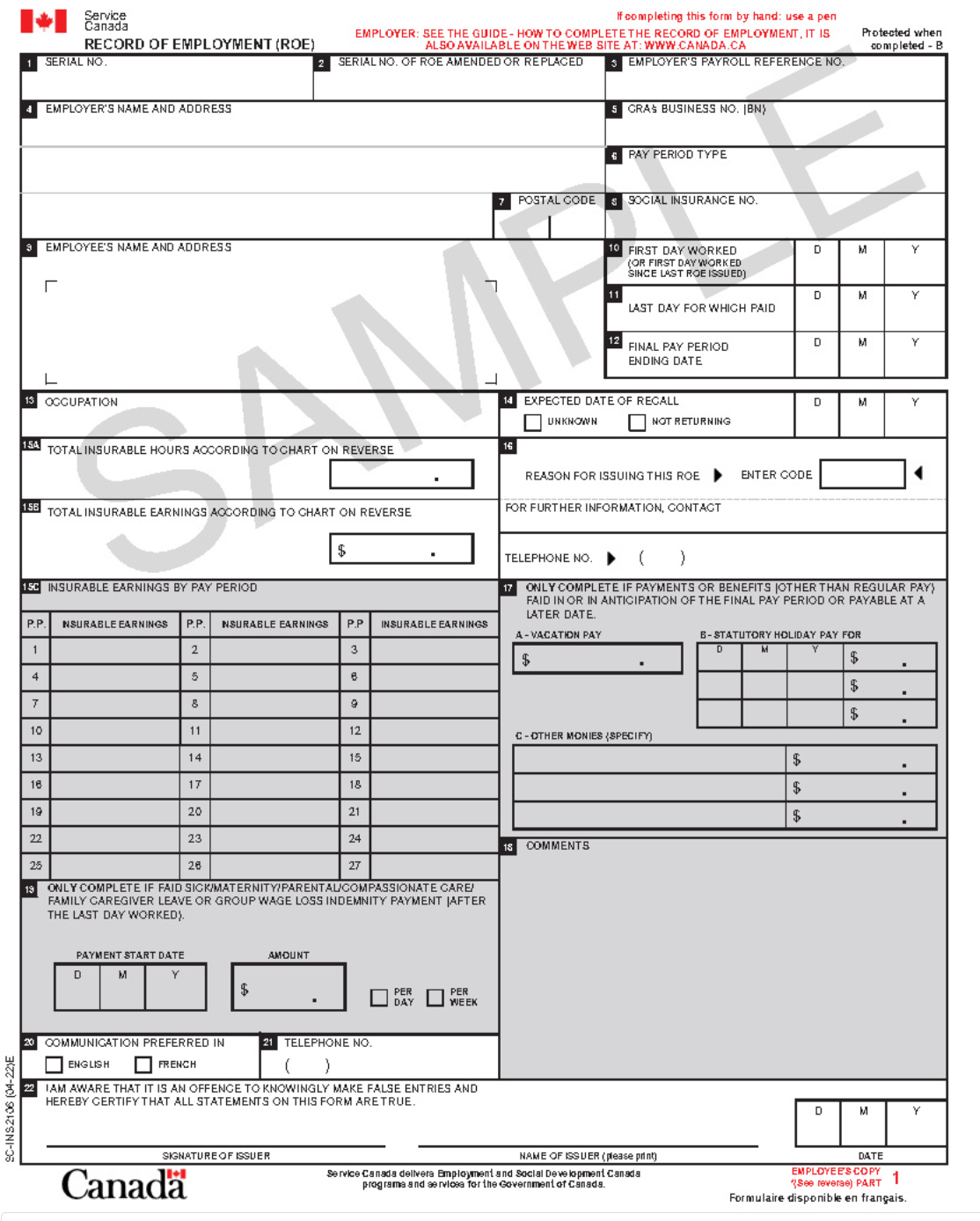

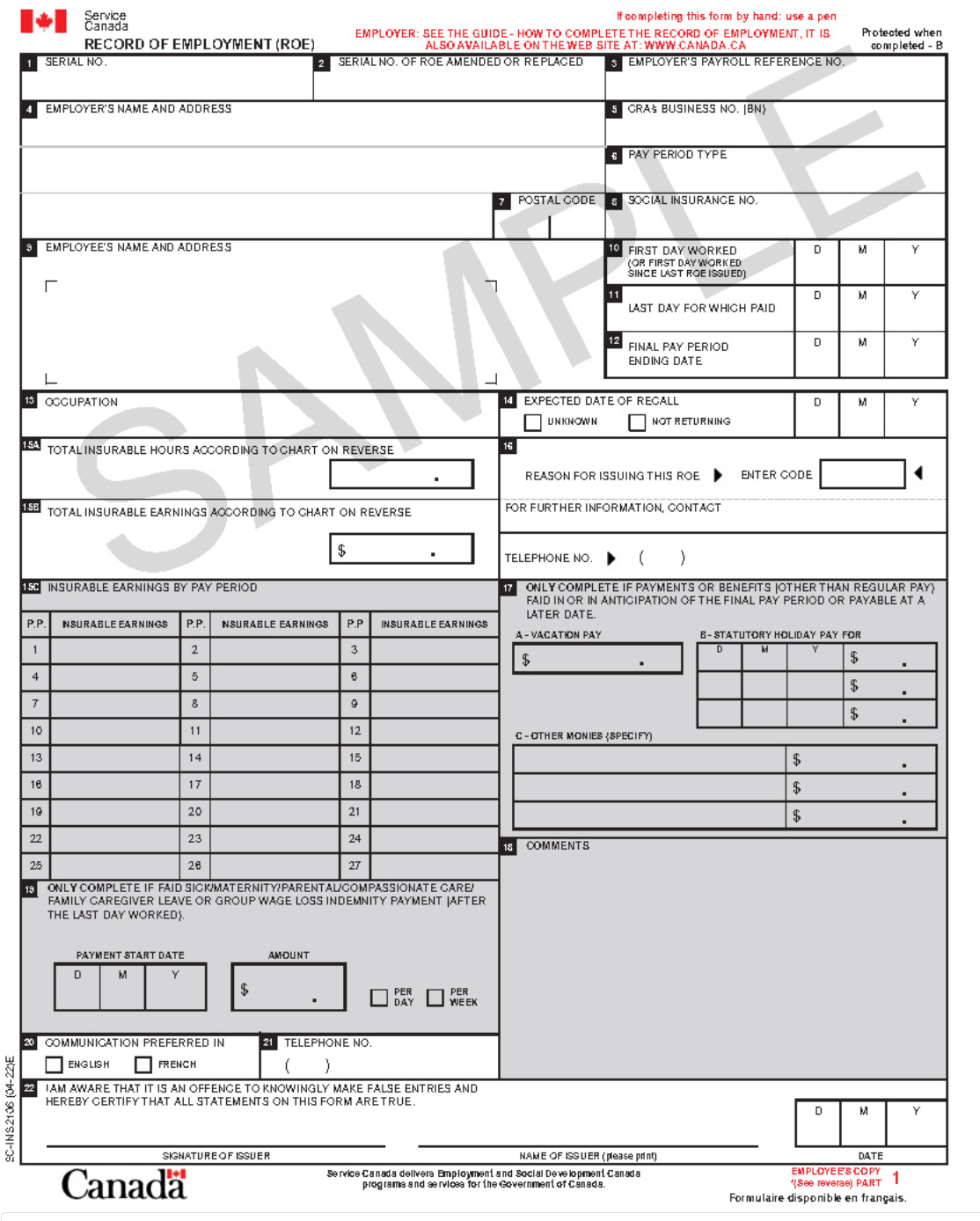

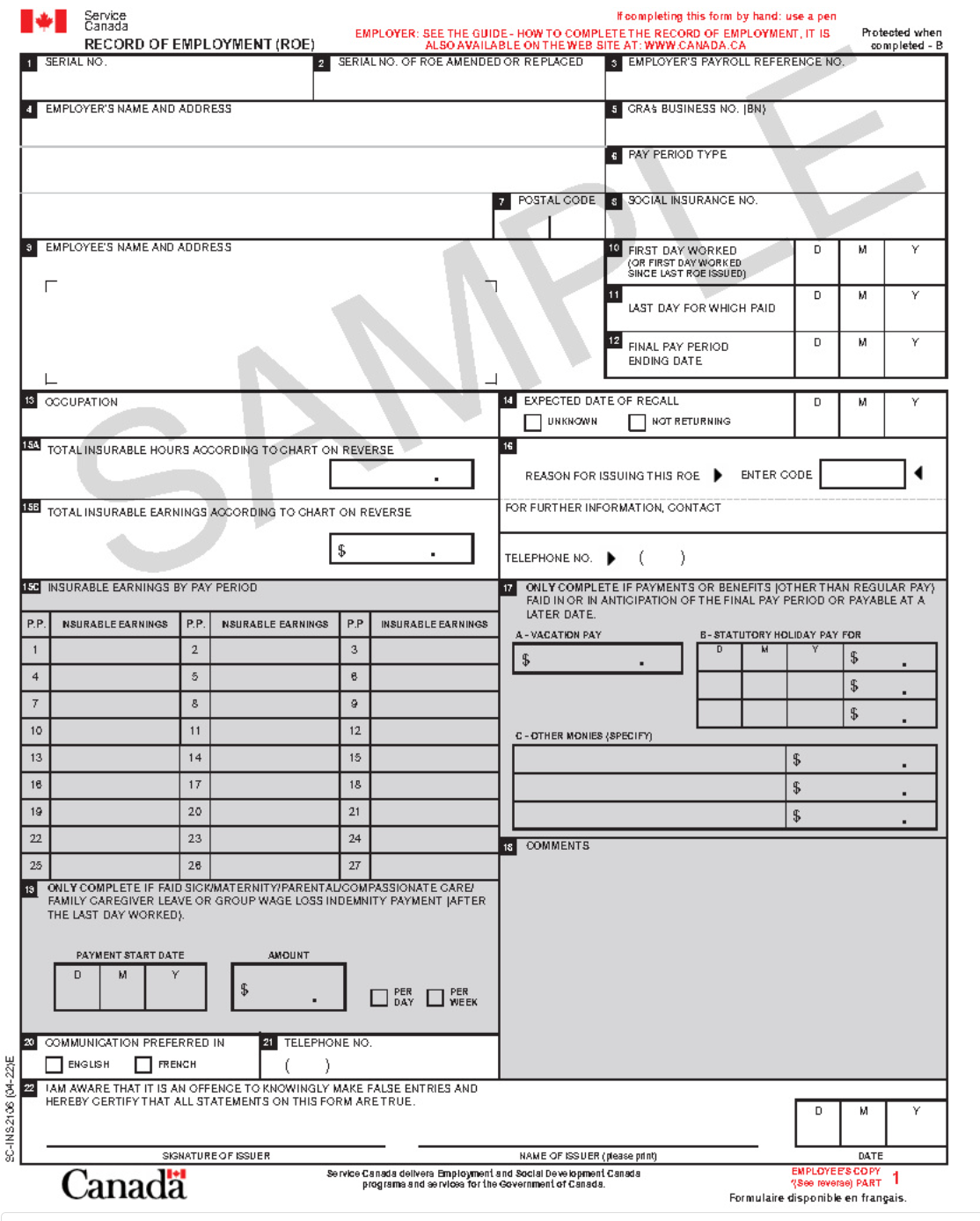

Completing an ROE involves several steps to ensure accurate and timely documentation of an employee’s employment history. The Service Canada (2021) publication How to Complete the Record of Employment form provides step-by-step instructions for completing an ROE. A sample ROE form and instructions are provided below:

Step 1: Administrative information (Blocks 1–9 and Blocks 13–14) can be completed in any order you like.

Step 2: Complete the period of employment information in Blocks 10, 11, and 12. This information provides you with the timeframe for which you need to report the employee’s insurable hours and earnings.

Step 3: Enter any separation payments paid or payable to the employee in Blocks 17A, 17B, and 17C.

Step 4: Calculate the insurable hours and enter them in Block 15A.

Step 5: If you need to complete Block 15C, do it next. Then enter the total insurable earnings in Block 15B. Remember to include the insurable separation payments you entered in Block 7 in the total amount you enter for the final pay period.

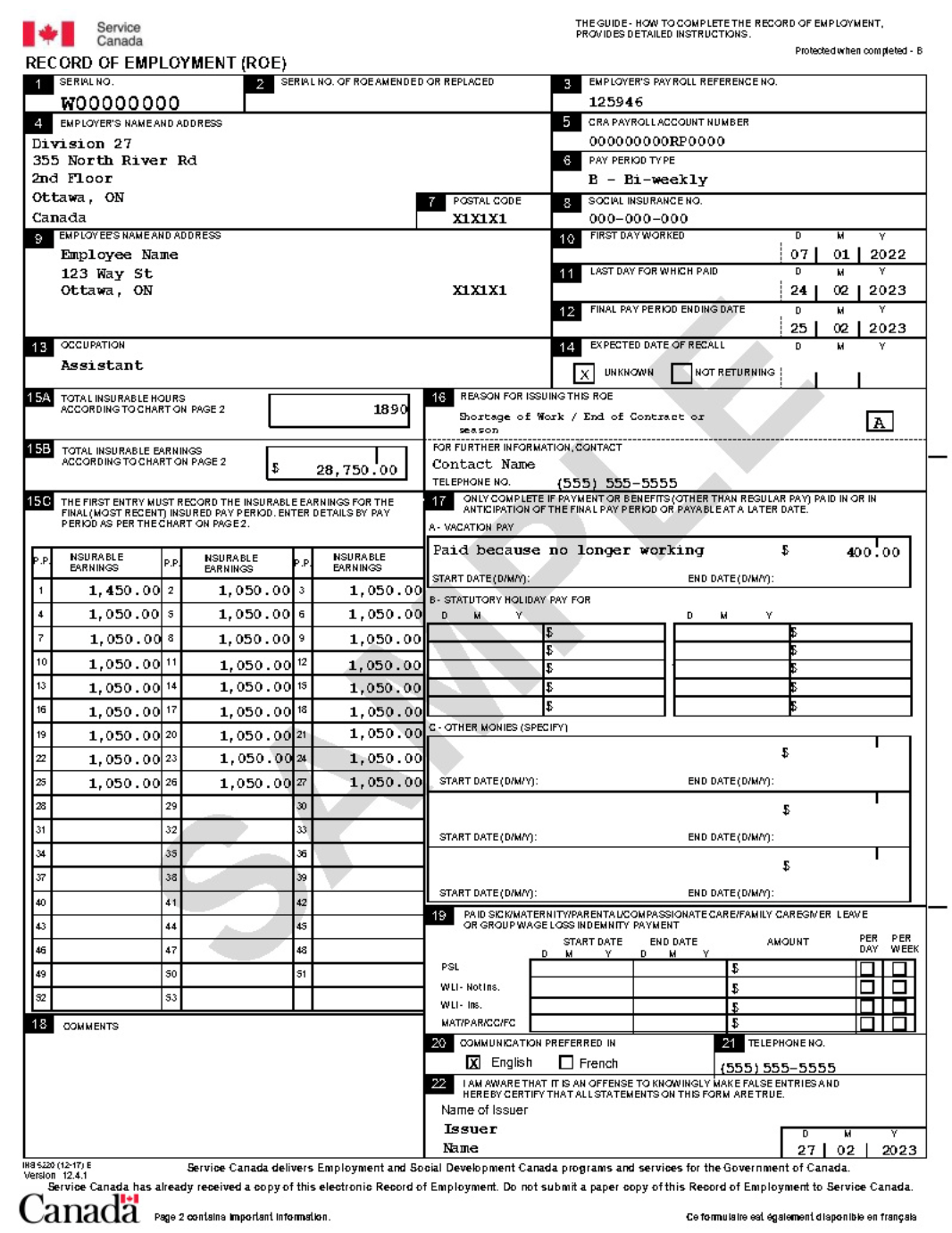

An example of a completed ROE form is shown below:

The following ROE blocks must be completed:

- Blocks 1 through 9, and Blocks 13 and 14 require administrative information to be inputted.

- Blocks 10 through 13 require information on the insurable hours and earnings during the employment period.

- Blocks 17A through 17C require amounts for any separation payments either paid or payable.

- Block 15A requires calculating insurable hours.

- Block 16 requires the reason for preparing the ROE.

- Block 18 allows the employer to record any additional information, usually for unique circumstances.

- Block 19 is completed when the employee is to receive paid leave related to illness, maternity, parental leave, compassionate leave, caregiver leave, and loss indemnity (group wage payment).

References

Government of Canada. (2024a). Access record of employment on the web for employers. https://www.canada.ca/en/employment-social-development/programs/ei/ei-list/ei-roe/access-roe.html

Service Canada. (2021). Employment insurance: How to complete the Record of Employment form. https://www.canada.ca/content/dam/canada/employment-social-development/migration/images/assets/portfolio/docs/en/reports/ei/roe_guide/pdf/3106-ROE-Web-layout-EN.pdf