Chapter 5: Net Pay

5.2 Calculating Net Pay

5.2.1 Steps for Calculating Net Pay

Net pay is typically calculated by payroll software; however, payroll professionals should have an understanding of how net pay is calculated in order to verify that the software is calculating net pay correctly.

The following is a simplified set of steps for calculating an employee’s net pay:

- Gather and verify all the necessary payroll information (employee information, pay information, and amounts and values of any taxable and non-taxable benefits and allowances).

- Determine gross earnings for the pay period.

- Calculate all deductions for the pay period.

- Calculate net pay (gross pay minus deductions) for the pay period.

Note that in this text, non-taxable benefits and allowances have not been treated as part of gross earnings. As non-taxable benefits and allowances do appear on an employee’s paycheque, they can be added to net earnings at the end of the calculation.

5.2.2 Gather and Verify Payroll-Related Information

5.2.2.1 Determine Employee Information

Employee information should have been collected by payroll when setting up the employee in payroll; see Chapter 1.4 Setting Up Payroll. Two key pieces of information are needed and should be gathered before processing net pay:

- The employee’s SIN, which must be collected within three days of the employment start date.

- Federal and provincial TD1 forms, also known as personal information returns. The TD1 form requires the employee to enter their social insurance number, date of birth, address, and applicable claims for income tax purposes; e.g., there are claim amounts for tuition paid by the taxpayer and claim amounts for eligible dependents. The TD1 must be returned to the employer within seven days of the employment start date (Government of Canada, 2022).

5.2.2.2 Determine Pay Information

Payroll should determine how the employee is being paid. For wage workers, determine the hourly rate, overtime rate, and pay periods: weekly, biweekly, semi-monthly, or monthly.

For salaried employees, divide the salary by the number of pay periods to determine the salary amount per pay period. For example, an annual salary of $40,000 paid biweekly would be divided into 26 pay periods ($40,000/26 pay periods = $1,538.26 per pay period).

Payroll should also determine, depending on each employee’s employment terms and conditions, whether the employee receives irregular earnings such as bonus payments. Before calculating net pay for an employee, payroll should determine whether the employee has any irregular earnings, termination payments, or other approved earnings. See Chapter 7.3 Termination of Employment for termination payments and procedures, and Chapter 3.3 Pay Periods and Pay Cycles for a more detailed discussion of irregular earnings.

Finally, payroll should determine the employee’s vacation rate and whether it is paid out or accrued. Employees may be receiving paid vacation time, or they may be paid out for their vacation entitlement if vacation time is not taken. In either case, if vacation impacts the pay period in question, this information is needed to calculate net pay.

5.2.2.3 Determine Taxable Benefits

Employee benefits (employment “perks”) can be either taxable or non-taxable, and taxable benefits can be cash or non-cash (usually non-cash). Once a benefit has been identified, the next step for payroll is to determine whether the benefit is taxable. Generally, if the benefit is of measurable value and is of benefit to the employee (as opposed to the employer), the benefit is taxable. For example, when an employer pays for employees’ health club memberships, the employee is the one who primarily benefits and the value is measurable. Non-taxable benefits might be of advantage to the employer and not (primarily) the employee. A mobile device that the employee is required to use for work purposes is an example of a non-taxable benefit. See the CRA guide for more details: Employers’ Guide: Taxable Benefits and Allowances

If a taxable benefit is provided on a schedule other than the pay cycle, the value of the benefit should be divided into the applicable number of pay periods. For example, if the employer is paying for an employee’s life insurance premiums of $500 per month and the employee is being paid biweekly, the amount will need to be converted to biweekly amounts: $500/month × 12 = $6,000 per year; $6,000 per year/26 pay periods = $230.77 per pay period.

5.2.2.4 Determine Taxable and Non-Taxable Allowances

Allowances, if taxable, are subject to deductions and treated the same as taxable benefits. Payroll’s task is to identify any allowances and then determine whether the allowance(s) are taxable or non-taxable. Generally, if the allowance is reasonable, it will be non-taxable.

For example, if an employee is receiving an automobile allowance, it will not be taxable if it is based on the per kilometre rate that the CRA considers “reasonable.” The CRA website lists reasonable automobile allowance rates. For 2024, the rates are $0.70 for the first 5,000 kilometres and $0.64 per kilometre in excess of that. If the automobile allowance is not based on these rates, it would be deemed unreasonable and considered a taxable allowance that must be included in the employee’s income.

An allowance for protective clothing such as uniforms and safety shoes is another common type of allowance that may be provided to an employee by the employer. This type of allowance will be non-taxable if it is reasonable and if it is mandatory for the employee to wear protective clothing.

Read more about allowances here: Employers’ Guide: Taxable Benefits and Allowances

5.2.2.5 Determine Whether Deductions (Other than Source Deductions) Must Be Made

Payroll should determine whether the employer is obligated to deduct any amounts other than CPP, EI, and income tax from the employee’s pay. For instance, the employer may be obligated by court order to carry out wage garnishment or may be required by a unionized employee’s collective agreement to deduct union dues. The employer may also have agreed with the employee to make certain deductions; for example, deductions for life insurance or health coverage.

At the information-gathering stage, payroll should ensure that they have been informed about any non-source deductions from employee pay.

5.2.3 Calculate Gross Earnings

Gross earnings for regular and any irregular earnings must be determined before net pay can be calculated. Gross earnings can be in the form of salary, wages (with or without overtime, as applicable), vacation pay, holiday pay, commission, piecework, bonuses, retroactive pay, director’s fees, and so on. For more details on how to assess gross earnings, see Chapter 3.4 How to Calculate Gross Earnings.

Gross earnings for regular and any irregular earnings must be determined before net pay can be calculated. Gross earnings can be in the form of salary, wages (with or without overtime, as applicable), vacation pay, holiday pay, commission, piecework, bonuses, retroactive pay, director’s fees, and so on. For more details on how to assess gross earnings, see Chapter 3.4 How to Calculate Gross Earnings.

5.2.4 Determine Pensionable Earnings and Calculate Employee CPP Contributions

Recall that pensionable earnings are gross earnings plus taxable benefits. Taxable allowances also fall under the umbrella of taxable benefits for the purpose of determining pensionable earnings; allowances that are considered “reasonable” by the CRA are non-taxable and should not be included in pensionable earnings.

Payroll should determine pensionable earnings for the pay period, subtract the basic exemption, and multiply the result by the current year’s CPP rate to determine the employee’s CPP deduction; see Chapter 4.2 Source Deductions for more information.

5.2.5 Determine Insurable Earnings and Calculate Employee EI Premiums

Recall that insurable earnings are gross earnings plus cash taxable benefits and taxable allowances. Non-cash taxable benefits are not considered part of insurable earnings.

Payroll should determine an employee’s insurable earnings for the pay period and multiply the insurable earnings by the current year’s EI rate to determine the employee’s EI deduction; see Chapter 4.3 Employment Insurance for more information.

5.2.6 Determine Gross Taxable Earnings, Net Taxable Earnings, and Income Tax Deductions

Income tax is calculated on net taxable earnings; payroll software should have the correct rates and be able to calculate income tax deductions, factoring in the relevant tax credits. The CRA’s payroll deductions online calculator (PDOC) will also calculate income tax deductions, factoring in the TD1 and other deductions as provided. Net taxable income can also be calculated manually, and the payroll deduction tables can be used to obtain the applicable federal and provincial income tax deductions.

5.2.6.1 Gross Taxable Earnings

Gross taxable earnings include gross income and any taxable benefits. Allowances and reimbursements may fall under the umbrella of taxable benefits, but if allowance or reimbursement amounts are not in line with what the CRA considers reasonable, these amounts will be considered taxable. Generally, if an amount provided to an employee is not to the employer’s benefit but rather to the employee’s benefit, these amounts count as taxable benefits. The taxable status of benefits, allowances, and, more rarely, reimbursements can be complex. An employer can obtain guidance from the CRA by calling the business inquiries line at 1-800-959-5525.

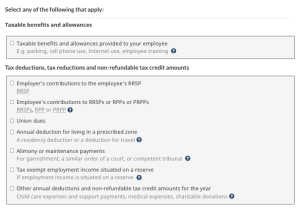

5.2.6.2 Calculate Net Taxable Earnings

The TD1 amounts should be deducted from gross taxable income, as should union dues and registered pension plan contributions made through payroll. If using the CRA’s online payroll calculator (PDOC), payroll should be sure to include the appropriate federal and provincial TD1 amounts, and check off the relevant boxes to ensure that net taxable income is calculated accurately.

5.2.6.3 Calculate Income Tax

Payroll should determine federal and provincial income tax using the employer’s payroll software. If the employer is not using software, use the payroll deduction tables or the CRA’s online payroll calculator (PDOC) instead; see Chapter 4.4 Income Tax for more detailed guidance on using the PDOC and for a link to the payroll deduction tables.

Note that there may be complex tax considerations for certain kinds of earnings. For example, although retroactive payments are subject to deductions including tax, some qualifying lump sum retroactive payments will have special tax treatment, and the tax deduction may need to be calculated differently (Government of Canada, 2023b).

5.2.7 Calculate Total Deductions

Total deductions include federal and provincial income tax, the employee’s CPP deduction, and the employee’s EI deduction for the pay period. If there are any other deductions, those should also be included in this total; see Chapter 4 for a more detailed discussion of deductions.

For net pay calculations, payroll should calculate the total of all deductions: source deductions, other mandatory deductions (if applicable), and any non-mandatory deductions.

5.2.8 Calculate Net Pay

To calculate net pay, add gross earnings and taxable benefits and allowances. From this amount, subtract total deductions, as calculated above. Finally, add any non-taxable benefits or allowances that will be paid through payroll (reimbursements are typically not paid through payroll, but allowances and cash benefits are). These amounts do not impact the calculations completed in earlier stages, but because they are paid to the employee through payroll and appear on the employee’s paycheque, they should be added to net pay as a last step.

References

Government of Canada. (2024). Payroll deductions online calculator. https://apps.cra-arc.gc.ca/ebci/rhpd/beta/ng/entry

Government of Canada. (2023a). Automobile allowance rates. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/benefits-allowances/automobile/automobile-motor-vehicle-allowances/automobile-allowance-rates.html

Government of Canada. (2023b). Bonuses, retroactive pay increases or irregular amounts. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/payroll-deductions-contributions/special-payments/bonuses-retroactive-pay-increases-irregular-amounts.html

Government of Canada. (2023c). Employers’ guide: Taxable benefits and allowances. https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4130/employers-guide-taxable-benefits-allowances.html

Government of Canada. (2022). Set up and manage employee payroll information: Get the completed TD1 forms from the individual. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/set-up-new-employee/filing-form-td1.html

Image Credits (images are listed in the order they appear)

Calculator and pen by Shutterbug75, Pixabay licence

Government of Canada. (2024). Salary calculation [Screenshot]. https://apps.cra-arc.gc.ca/ebci/rhpd/beta/step2