Chapter 4: Statutory and Non-Statutory Deductions

4.1 Overview

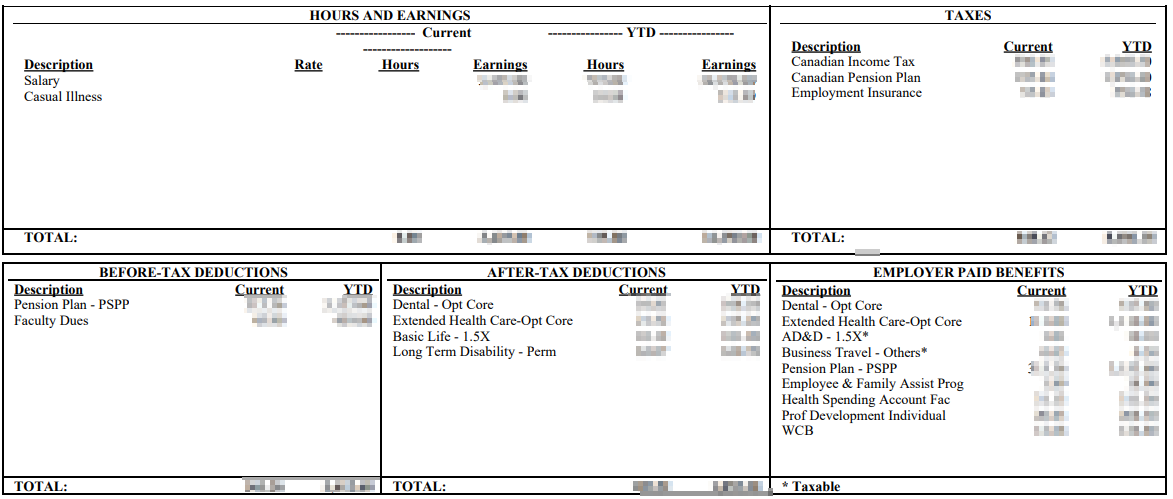

In this chapter, you will learn about the most common payroll deductions from employees’ gross pay. There are three categories of deductions you will learn about: 1) source deductions, which are mandatory by law; 2) other mandatory deductions; and 3) non-mandatory or optional deductions.

Source deductions are required for all Canadian employees. The three source deductions are CPP contributions, EI contributions, and income tax. For each, you will learn what income is subject to deductions, about maximum income thresholds where applicable, and how to calculate the amount of the source deductions.

Several mandatory deductions are also discussed; you will learn about deductions made when the CRA issues a Requirement to Pay (RTP), court-ordered wage garnishment, wage assignments (not permitted by law in most jurisdictions, with some limited exceptions), union dues, and pension contributions.

Finally, you will learn about optional or non-mandatory payroll deductions, including deductions for health benefit plans, insurance, and social funds. Other deductions may be agreed upon between employers and employees, and deductions by agreement are discussed briefly.

Payroll deductions are a key element of payroll processing. By learning how to accurately assess these deductions, payroll professionals gain key knowledge that ensures compliance with the law and accurate pay processing for employees.

Specific Learning Outcomes

Upon successful completion of this chapter, you will be able to

- Identify the three statutory source deductions: CPP, EI, and income tax

- Determine which earnings are subject to CPP deductions and calculate employee CPP contributions

- Determine which earnings are subject to EI deductions and calculate employee EI deductions

- Determine taxable earnings and calculate income tax withholdings

- Identify other mandatory deductions and when they apply

- Identify non-mandatory (optional) payroll deductions and when they apply

Image Credit

Employee pay stub by Meena Gupta, NorQuest College