Chapter 3: Gross Earnings

3.2 Key Terms

allowance: An amount paid by an employer to an employee over and above earnings to offset the cost of work-related expenses, without the employee having to provide receipts for those expenses. Allowances can be paid periodically or as a lump sum amount.

earnings: An amount or amounts paid by an employer to an employee for a specified period. Earnings can take different forms, including salary, wages, rate per piece of goods produced, and sales commissions. They are taxable, insurable, and pensionable, so are subject to all deductions.

employment income: The total compensation that an employee receives, including salary, wages, gratuities, overtime, and any other taxable benefits.

expense reimbursement: An amount paid by an employer to an employee to repay approved work-related expenses; to be reimbursed, an employee must show receipts for expenses. Expense reimbursements are often paid by an Accounts Payable department rather than through payroll.

gross earnings: The total amount of earnings that an employer pays an employee in a specified period, before deductions.

non-regular earnings: Earnings that fall outside the category of regular earnings and include retroactive earnings (back pay), bonuses, and vacation pay. Non-regular earnings are not paid on a regular schedule and can be difficult to predict.

non-taxable benefits: Employment perks that are not considered part of employment income. Non-taxable benefits can include disability insurance, educational assistance, health insurance and equipment provided by the employer exclusively for work-related purposes.

pay cycle: The frequency that an employer pays its employees. The pay cycle determines the intervals in which employees are paid and can be weekly, biweekly, monthly, or any time interval the organization chooses, within the scope of employment standards legislation.

payday: The day an employee is paid for a previous pay period.

pay period: Sometimes used interchangeably with pay cycle. The length of time corresponding to one pay cycle. For an employee paid biweekly, one pay period might be December 31, 2023, to January 14, 2024.

regular earnings: Earnings paid on a regular, predictable schedule; can include wages, salary, commission (if paid predictably), and piece-rate pay (if paid predictably).

retroactive earnings: Sometimes also called back pay. A payment made during a current pay period for any amount that an employer owes an employee from a previous pay period.

retroactive earnings: Sometimes also called back pay. A payment made during a current pay period for any amount that an employer owes an employee from a previous pay period.

salary: The amount an employee is paid on a regular basis for their work. Salaries are often calculated yearly and paid weekly, biweekly, semi-monthly, or monthly. An employee gets a similar amount of money every pay period.

taxable benefits: Employment perks, either cash or non-cash, that have a monetary value and benefit the employee. These benefits might include company vacations, gift cards, membership to clubs, and tickets to events.

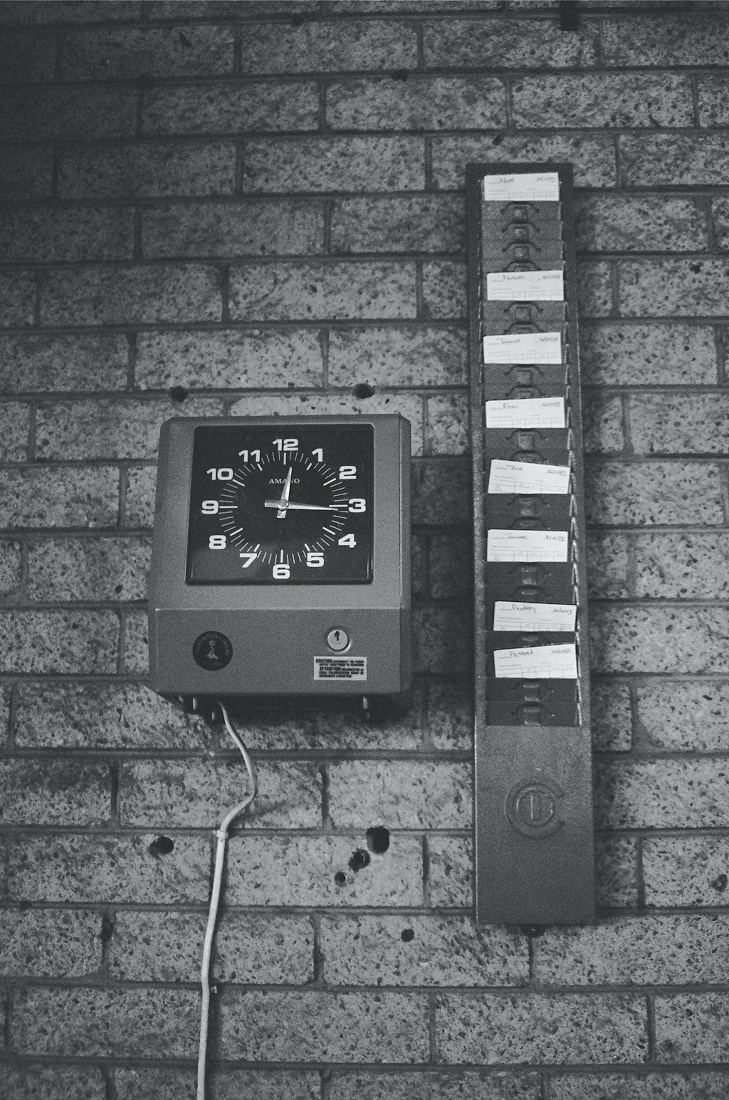

timecard: A card used to mechanically enter an employee’s start and end time each workday. Where timecards are used, payroll personnel can use the card to determine the number of hours an employee will be paid for.

wage: An amount paid to an employee on an hourly basis for hours worked. Wages are paid on a regular schedule.

Image Credit

An employee timecard machine by Hennie Stander, Unsplash licence