Chapter 4: Statutory and Non-Statutory Deductions

4.2 Source Deductions

Payroll is required to make three source deductions (also referred to as statutory deductions) for all employees: Canada Pension Plan contributions, Employment Insurance premiums, and income tax. These deductions are mandatory by law; see Chapter 2 for an explanation of the legislation authorizing and requiring source deductions.

4.2.1 Canada Pension Plan

The Canada Pension Plan (CPP) is a monthly, taxable benefit, designed to replace part of a recipient’s income upon retirement or disability. Employees contribute to the CPP via payroll deductions withheld and remitted by their employers.

The Canada Pension Plan (CPP) is a monthly, taxable benefit, designed to replace part of a recipient’s income upon retirement or disability. Employees contribute to the CPP via payroll deductions withheld and remitted by their employers.

Employees’ contributions begin when an employee turns 18 years old and continue until the employee is 70, with an opt-out election available to employees from 65 to 69 years of age who are receiving a CPP pension (Government of Canada, 2018). Employers should not deduct CPP for employees younger than 18, employees 70 years of age or older, or employees aged 65 to 69 who have elected to not have CPP deducted.

CPP contributions are collected on employment earnings after an employee has earned more than the basic exemption amount (currently $3,500), up to a yearly maximum amount called the Yearly Maximum Pensionable Earnings (YMPE). The YMPE amount changes annually. The basic exemption amount may change but does not typically change every year. Payroll professionals should annually check the YMPE and the basic exemption amount, and can do so here: Calculate payroll deductions and contributions: CPP contribution rates, maximums and exemptions

CPP applies to certain income, called pensionable earnings. Pensionable earnings are the sum of the employee’s gross pay (discussed in Chapter 3), including any taxable benefits, allowances, and controlled tips. Common taxable benefits that would be included in pensionable earnings are list in the table below:

|

Taxable Benefit |

Description |

|

Board and lodging |

The value of free or subsidized accommodations |

|

Automobile benefits |

The personal use of a company vehicle |

|

Gifts and awards |

Non-cash gifts or awards given to employees |

|

Healthcare premiums |

Healthcare premiums paid by employers, unless premiums are paid to a private healthcare plan |

|

Travel benefits |

Employer-paid or subsidized travel expenses |

|

Group term life insurance |

Coverage provided by the employer |

|

Tuition fees |

Employer-paid or reimbursed education expenses |

|

Parking |

The value of employer-provided parking spaces |

|

Low-interest or no-interest loans |

Loans provided by the employer at below-market rates |

|

Cellphones |

Employer-provided cellphones or plans |

|

Transit passes |

Employer-provided transit passes |

|

Fitness memberships |

Employer-paid or subsidized gym memberships |

|

Club memberships |

Employer-paid or subsidized club memberships |

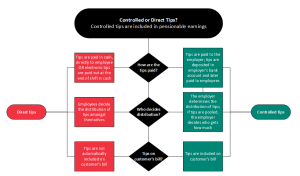

For employees who earn tips or gratuities (for example, servers in a restaurant), some tips are included in employment income. There are two categories of tips: controlled tips, which are included in pensionable earnings; and direct tips, which are not included. Controlled tips are tips controlled by the employe; that is, they are paid by customers to the employer, who then distributes them to the employees (Government of Canada, 2020). Direct tips are tips given by customers to employees directly, usually in cash (Government of Canada, 2020). It can sometimes be difficult to determine whether tips are controlled or direct. The following factors can help payroll professionals determine whether tips are controlled and therefore pensionable income: 1) whether the employer or the employees decide how to distribute the tips; 2) whether the tips are deposited into the employer’s bank account; and 3) whether the employer includes a tip or gratuity on the customer’s bill. Any one of the above situations establishes that the employer is controlling the employees’ tips is enough for the tips to be considered pensionable income.

Director’s fees are included in pensionable earnings, whether or not the director is paid a salary (for directors who reside in Canada). For more information about director’s fees and about resident and non-resident status, see Directors’ fees.

Read more about what is and isn’t included in pensionable earnings here: Employers’ Guide: Amounts and benefits from which you have to deduct CPP contributions

4.2.1.1 CPP Calculation

An employee’s CPP contribution is calculated as follows for each pay period:

CPP Contribution = (Pensionable Earnings – Basic Exemption Amount) × Current Year CPP Contribution Rate

For earning over the Maximum Annual Pensionable Earnings amount, there is a second additional CPP contribution (CPP2). The Additional Maximum Annual Pensionable Earnings amount and rate changes annually.

For 2024, the Additional Maximum Annual Pensionable Earnings amount is $73,200. Employees contribute 4% of their earnings between $68,500 (the Maximum Annual Pensionable Earnings amount) and $73,200 (the Additional Maximum Annual Pensionable Earnings amount).

If payroll is conducted using software, the software should accurately calculate the CPP amount. The CRA’s online payroll calculator can also be used to determine employee CPP contributions.

CPP should always be calculated based on the current rates (CPP and CPP2). You can check rates here: Calculate payroll deductions and contributions: CPP contribution rates, maximums and exemptions

Rates are typically updated in November for the following calendar year.

The steps for calculating CPP contributions manually are provided by the CRA (Government of Canada, 2023d) and summarized in the following example below:

CPP Calculation Example

Anjali earns a salary of $46,800, paid biweekly. for this pay period, she earned $1,800 in gross earnings and received $75 in taxable benefits. The basic CPP exemption amount for 2024 is $3,500. Calculate Anjali’s CPP contribution for the current pay period.

|

Step |

Instructions |

|

Step 1 |

Divide the basic CPP exemption amount by the number of pay periods: $3,500/26 pay periods = $134.61 (do not round to the nearest cent) |

|

Step 2 |

Calculate the employee’s total pensionable earnings for the pay period: Total Pensionable Earnings = Gross Income + Taxable Benefits and Allowances for the pay period Total Pensionable Earnings = $1,800 + $75 = $1,875 |

|

Step 3 |

Subtract the basic CPP pay period exemption from the total pensionable earnings for the pay period: $1,875.00 – $134.61 = $1,740.39 |

|

Step 4 |

Multiply the result of Step 3 by the current year’s CPP contribution rate (for 2024, the current rate is 5.95%): CPP Contribution for the pay period = $1,740.39 × 0.0595 = $103.55 |

Anjali’s CPP contribution for the current pay period is $103.55. Note that since Anjali’s income is under the Maximum Annual Pensionable Earnings threshold, she will not hit the contribution limit; also, CPP2 will not apply.

References

Government of Canada. (2024). Directors’ fees. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/payroll-deductions-contributions/special-payments/directors-fees.html

Government of Canada. (2023a). Calculate payroll deductions and contributions: CPP contribution rates, maximums and exemptions. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/payroll-deductions-contributions/canada-pension-plan-cpp/cpp-contribution-rates-maximums-exemptions.html

Government of Canada. (2023b). Employers’ guide – Payroll deductions and remittances. https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4001/employers-guide-payroll-deductions-remittances.html#P390_33979

Government of Canada. (2023c). Manual calculation for CPP. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/payroll-deductions-contributions/canada-pension-plan-cpp/manual-calculation-cpp.html

Government of Canada. (2020). Tips and gratuities. https://www.canada.ca/en/revenue-agency/services/tax/canada-pension-plan-cpp-employment-insurance-ei-rulings/cpp-ei-explained/tips-gratuities.html

Government of Canada. (2018). Starting and stopping CPP deductions. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/payroll-deductions-contributions/canada-pension-plan-cpp/starting-stopping-cpp-deductions.html

Image Credit

Piggybank with maple leaf by Meena Gupta, NorQuest College