Chapter 1: Introduction to Canadian Payroll

1.4 Setting Up Payroll

1.4.1 Setting Up Payroll for an Organization

Any individual or organization with one or more employees must set up a payroll account with the Canada Revenue Agency (CRA) and decide whether or not to use payroll software. If you are using payroll software, the organization will decide which software to use. Larger organizations usually employ payroll administrators or outsource the payroll function of the organization.

Note: Remember that employees and independent contractors are not the same; see Chapter 2 for an explanation.

1.4.1.1 Setting up a Payroll Account with the Canada Revenue Agency (CRA)

Any individual, corporation, or organization that will be paying an employee or employees should set up a payroll account with the CRA. A payroll account is necessary to remit payroll deductions and employer payroll expenses, both of which are mandated by law. Payroll deductions from employees’ pay include income taxes, employee Canada Pension Plan (CPP) contributions, and employee Employment Insurance (EI) premiums. An employer’s payroll expenses include the employer’s Canada Pension Plan (CPP) contributions and the employer’s Employment Insurance (EI) premiums.

A payroll account is a “sub” account; the main account is the business number (BN) assigned to a corporation or organization by the CRA. The BN is a unique nine-digit identifier that must be used when communicating with the CRA about any program accounts, including payroll accounts (Government of Canada, 2023k).

To set up a payroll account in Canada, the employer must obtain a BN and can do so either by registering online or by filling out a business number (BN) registration form and mailing it to the CRA.

- Employers can register their BN online through the CRA website: Business Registration Online – Register

- Paper registrations can be done by filling out the business number (BN) registration form, RC1, available on the CRA website: RC1 Request for a Business Number and Certain Program Accounts

Employers can also obtain a BN through other registrations when setting up their organization. For example, when registering or incorporating a business in most Canadian provinces (excluding Quebec and Newfoundland), the organization also receives a BN (Government of Canada, 2023k). This BN can then be used to set up a payroll account with the CRA.

Payroll accounts must be set up before the first remittance of payroll deductions or employer expenses is due. The first remittance due date will depend on the employer’s “remitter type”; remitter types are set by the CRA based on the number of employees (Government of Canada, 2023f). It is important for employers to ensure that they have properly set up their payroll accounts in Canada and are remitting deductions on time and accurately to avoid penalties and interest charges.

If employers conduct business in more than one province or if the employer operates different business activities within the same business, the employer may wish to register more than one payroll account under the same BN and must apply to the CRA to do so (Government of Canada, 2023d). There should be only one BN per individual, organization, or legal entity, but there may be more than one “sub” account (payroll account) if the organization conducts more than one business activity or operates in more than one location.

1.4.1.2 Setting Up Accounts with Other Payees

In addition to setting up an account with the CRA, the employer will likely also need to set up accounts with other payees. These payees include provincial or territorial compensation boards (for example, in Alberta, employers pay premiums to the Workers’ Compensation Board), employer health tax (in applicable provinces), and insurance and benefit premiums. see Chapter 6 for a thorough review of these payees.

1.4.1.3 Determining Whether the Organization Should Use Payroll Software

Canadian employers can use either manual or computerized payroll systems. However, if an employer is processing payroll for more than 50 employees (that is, 50 T4 returns), using payroll software is recommended. This is because at or above 50 returns, the CRA requires employers to file their returns electronically (Government of Canada, 2023a).

The CRA will issue penalties for not filing electronically when employers are required to do so. These penalties are listed in the table below.

|

Penalties for Not Filing Electronically (>50 returns) |

|

|

Number of information returns (slips) |

Penalty |

|

51 to 250 |

$250 |

|

251 to 500 |

$500 |

|

501 to 2,500 |

$1,500 |

|

2,501 or more |

$2,500 |

(Government of Canada, 2023e)

Employers with up to 100 employers can use the CRA’s web forms to provide up to 100 returns (Government of Canada, 2023c). For employers with between 50 and 100 employees, filing returns via the CRA’s web forms will fulfil the electronic filing requirement. For more than 100 returns to be submitted electronically, employers will very likely need software to encode data for submission via internet file transfer in XML format (Government of Canada, 2023a). Although it is technically possible to encode all of an employer organization’s return data in an XML file without software, doing so is complex and requires technical expertise. The 2023 XML specifications for T4s can be found here: T4 Statement of Remuneration Paid

1.4.1.4 Choosing Suitable Payroll Software for the Organization

Employers opting to use payroll software should select software that can administer payroll in the jurisdiction or jurisdictions that the employer operates in. For example, a business operating in one or more Canadian provinces or territories should select Canadian payroll software or global payroll software that is set up to correctly administer payroll in Canada. Similarly, if a business operates in more than one country, the software should accurately process payroll according to the laws of each country. Before implementing software, and periodically to keep up with legislative changes, payroll should verify that the calculations completed by the software are accurate.

Global payroll is complex; the legal requirements that employers need to comply with vary significantly between countries. For example, in Belgium, employment laws require most workers to get an annual raise that is linked with inflation (Reuters, 2022). Employers operating internationally need to ensure that they are aware of the relevant payroll regulations and processes, and that the software the organization uses complies with the laws of each country the organization operates in.

When determining what payroll software to use, an organization should consider the organization’s size, whether the organization’s payroll department works remotely, the complexity of payroll calculations and reporting requirements, the jurisdiction(s) that the organization operates in, the level of data automation desired, the integration of payroll and other HR functions, and the budget available for the purchase and maintenance of the payroll software (Keogh, 2023). Each organization should be attentive to the ways in which these factors align with their needs.

Large organizations—those with 50 or more employees—are likely to require payroll software given the CRA’s electronic filing requirements for returns (see above). These organizations also require payroll software that can handle a larger volume of employee data. Remote access, via the internet or cloud storage, is also an important feature to consider for organizations that need remote-working capabilities. Additionally, large organizations may require payroll software with a higher degree of automation to manage increasing data complexity as employee numbers grow. It may be worthwhile for a large organization to obtain a software solution that integrates payroll processes with other HR functions such as time and attendance tracking or benefits management. In the case that an organization uses integrated payroll and HR software, it is important to check that the payroll aspects of the software meet the requirements of the organization’s specific jurisdiction(s) when it comes to payroll calculations and reporting.

Large organizations—those with 50 or more employees—are likely to require payroll software given the CRA’s electronic filing requirements for returns (see above). These organizations also require payroll software that can handle a larger volume of employee data. Remote access, via the internet or cloud storage, is also an important feature to consider for organizations that need remote-working capabilities. Additionally, large organizations may require payroll software with a higher degree of automation to manage increasing data complexity as employee numbers grow. It may be worthwhile for a large organization to obtain a software solution that integrates payroll processes with other HR functions such as time and attendance tracking or benefits management. In the case that an organization uses integrated payroll and HR software, it is important to check that the payroll aspects of the software meet the requirements of the organization’s specific jurisdiction(s) when it comes to payroll calculations and reporting.

An organization that operates in multiple jurisdictions must ensure that its payroll software complies with the tax laws and regulations of each jurisdiction; this is true of organizations operating internationally and within Canada (if the organization operates in more than one province or territory). Some reporting and remittance requirements are the same for organizations across Canada, whereas others are jurisdiction specific. For instance, CPP and EI deductions have federally mandated amounts and calculation methods, whereas provincial or territorial tax remittances may vary. Each province or territory also has its own employment standards, workers’ compensation premiums, and other regulatory requirements.

Small organizations—those with fewer than 50 employees and that operate in only one Canadian jurisdiction—if using payroll software, may opt for simpler payroll software solutions because their data processing requirements are not as complex. However, organizations of all sizes must consider privacy and security concerns related to employee data. Therefore, payroll software that complies with the relevant privacy regulations can be beneficial to any organization regardless of its size. Record of Employment (ROE) filing is also required by the CRA for all organizations whenever an employee’s employment is terminated and when an employee’s earnings are interrupted (for example, when an employee takes parental leave under the Alberta Employment Standards Code). Completing a ROE can be time-intensive for small organizations, so these organizations may benefit from payroll software that automatically generates ROEs.

Complex benefits and pension calculations are other factors that organizations should take into consideration when determining their payroll software needs. Organizations may offer stock options, profit-sharing programs, or other benefits that have specific calculations based on company policies or collective agreements with unions; these benefits may or may not have an impact on employee payroll deductions and/or employer payroll expenses. Employers should seek out payroll software that can process complex calculations accurately. Alternatively, employers should look for payroll software that can be customized, provided that the organization has the technical capacity to make customizations.

1.4.1.5 Determining Whether to Outsource Payroll Functions

Many organizations choose to outsource payroll functions. An organization may be particularly inclined to outsource payroll if it is a small or medium-sized organization with limited resources to manage payroll in-house, if the organization is rapidly growing and outpacing its current payroll capacity, if the organization operates in multiple jurisdictions, or if the organization has complex payroll. There are several payroll service providers in Canada for organizations seeking to outsource.

1.4.2 Setting Up an Employee in Payroll

Many employers’ payrolls are now managed through payroll software. Payroll administrators should ensure that the relevant employee information, such as a new employee’s SIN number, rate of pay, frequency of pay, start date, and other terms of employment, are entered correctly and promptly into the software system.

Some organizations conduct their payroll without using payroll software. Payroll records can be kept using spreadsheets or the paper equivalent, but manual payroll records must still be set up correctly and the proper remittances and reporting must still be provided to the CRA. To determine whether your organization should use payroll software and to learn more about payroll software, see “Setting Up the Organization,” above.

1.4.2.1 Collecting and Validating Employee Information

1.4.2.1.1 SIN

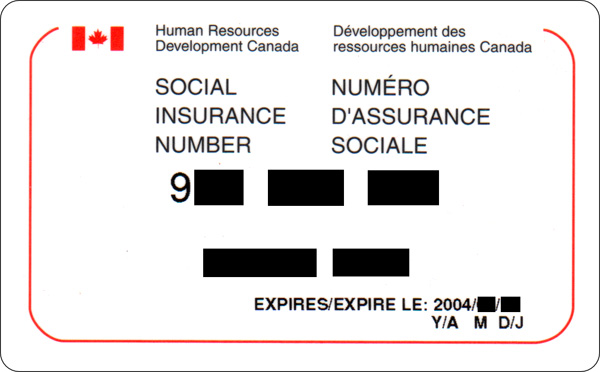

Employers are responsible for obtaining a valid Social Insurance Number (SIN) from employees. A Social Insurance Number is a number issued by the Canadian government to individuals who are residents of Canada, including temporary residents. A SIN is required to work in Canada and to access government programs and benefits (Government of Canada, 2023i). Employees must provide a SIN to their employer within three days of starting work; if an employee does not have a SIN, the employee must apply for one and provide it to the employer within three days of receiving it (Government of Canada, 2023h). Note that employers should not ask for an employee’s SIN until after a candidate has been hired. Although it is not unlawful to do so, asking for a SIN before a candidate is hired is strongly discouraged (Government of Canada, 2023j).

Payroll professionals must accurately enter each SIN—an inaccurate SIN can have future consequences for an employee’s ability to access government benefits and programs. Payroll must also verify that the SIN for a temporary resident has not expired. Temporary residents in Canada who have a SIN will have a number starting with the numeral nine (9), as can be seen in the image above. All SIN numbers beginning with nine (9) should have an expiry date (Government of Canada, 2023j).

1.4.2.1.2 TD1 Personal Tax Credits Return

A TD1 form requires employees to provide information that impacts the amount of income tax that an employer will deduct. Every employee is eligible for a basic personal deduction. Beyond the basic personal amount, employees may be eligible for deductions based on their personal situation; for example, whether they support dependents, are tuition-paying students, or have a documented disability.

An employee must complete TD1 forms (federal and provincial) within seven days of a change in any personal circumstances impacting the TD1 (Government of Canada, 2023b). New employees should complete a TD1 when starting employment. If the employee is working for more than one employer, the employee cannot claim the amounts on the TD1 form twice, but must still submit a TD1 form with zero amounts and check the “More than one employer or payer at the same time” box (Government of Canada, 2023b).

1.4.2.1.3 Province of Employment

Employers must record each employee’s province or territory of employment, which is reported on the employee’s T4. Please see the chart below to determine what to record:

|

Situation |

Province or Territory of Employment |

|

The employee works in more than one province or territory. |

Record each province or territory; a T4 will have to be issued for each region separately. |

|

The employee reports to work in person. |

Record the province or territory where the employee reports to work. |

|

The employee works remotely. |

Record the province or territory where the employee is paid (usually where the payroll records are kept). |

(Government of Canada, 2023g)

1.4.2.1.4 Verifying Rate of Pay and Terms of Employment

Although payroll professionals do not determine employees’ rate of pay, frequency of pay, number of holidays, or benefits, they are responsible for upholding the terms of the employment contract or collective agreement through the administration of payroll.

The terms of most workers’ employment are set through an employment contract. If the employment contract is in writing, the employee and employer (HR) should check to ensure that the terms of employment in the written contract match what was discussed during the hiring process. Payroll professionals should be able to rely on the rate of pay and other terms set out in the contract when enrolling a new employee in the organization’s payroll program. If the payroll professional notices an error, for instance, a salary or wage lower than the statutory minimum wage, they should verify that the contract is correct with the hiring manager or appropriate HR personnel. If the contract is verbal, it is a good idea for payroll to ask for a record from HR documenting the rate of pay, sick days, holidays, benefits, and any other terms of employment that impact payroll.

Unionized workers negotiate the terms of their employment through a collective agreement. This agreement is negotiated by the union on behalf of the workers and management on behalf of the employer. Collective agreements typically detail rate of pay and other employment conditions. Payroll professionals can verify that a new employee is being paid according to the collective agreement. If the payroll professional thinks there is an error, they should bring their concerns to the hiring manager or appropriate HR personnel.

References

Government of Canada. (2023a). Electronic filing methods. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/completing-slips-summaries/t4rsp-t4rif-information-returns/when-file/electronic-filing-methods.html

Government of Canada. (2023b). Employers’ guide – Payroll deductions and remittances. https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4001/employers-guide-payroll-deductions-remittances.html

Government of Canada. (2023c). Filing information returns electronically (T4/T5 and other types of returns) – What you should know before. https://www.canada.ca/en/revenue-agency/services/e-services/filing-information-returns-electronically-t4-t5-other-types-returns-overview/filing-information-returns-electronically-t4-t5-other-types-returns-what-you-should-know-before.html

Government of Canada. (2023d). Opening more locations, branches or divisions. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/changes-your-business/opening-locations-branches-divisions.html

Government of Canada. (2023e). Penalties and interest. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/completing-slips-summaries/financial-slips-summaries/part-xviii-information-return-international-exchange-information-on-financial-accounts/penalties-interest.html

Government of Canada. (2023f). Remit (pay) payroll deductions and contributions: When to remit. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/remitting-source-deductions/how-when-remit-due-dates.html#h-2

Government of Canada. (2023g). Set up and manage employee payroll information: Determine the province of employment (POE). https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/set-up-new-employee/determine-province-employment.html

Government of Canada. (2023h). Set up and manage employee payroll information: Get the social insurance number (SIN) from the individual. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/set-up-new-employee/social-insurance-number.html

Government of Canada. (2023i). Social insurance number. https://www.canada.ca/en/employment-social-development/services/sin.htm

Government of Canada. (2023j). Social insurance number: Protecting your SIN. https://www.canada.ca/en/employment-social-development/services/sin/protection.html

Government of Canada. (2023k). When you need a business number or Canada Revenue Agency program accounts. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/registering-your-business/you-need-a-business-number-a-program-account.html

Keogh, L. (2023). 10 things to help you choose the right payroll software. Sage Advice. https://www.sage.com/en-ie/blog/10-things-to-consider-when-choosing-payroll-software-for-your-business/

Reuters. (2022, October 28). One million Belgian employees expected to get 11.6% pay raise due to inflation. https://www.reuters.com/world/europe/one-million-belgian-employees-expected-get-116-pay-raise-due-inflation-2022-10-28/

Image Credits (images are listed in order of appearance)

Computer screen showing payroll register by Meena Gupta, NorQuest College

SIN card by Wagner51, CC BY-SA 3.0

Person signing contract by Pixabay, Pexels licence